betterment tax loss harvesting wash sale

Realized gains or losses are the result of sales you have made throughout the year. I believe all the ones with zeros are profitable sales so it.

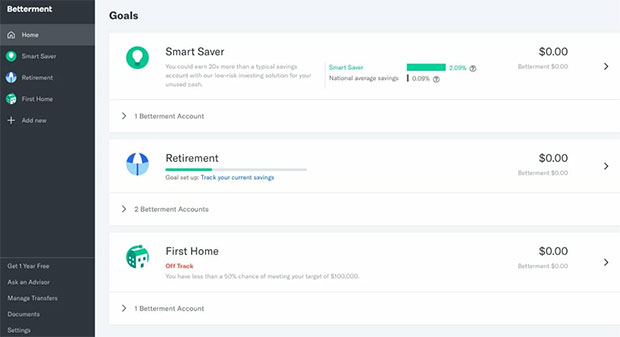

Is Betterment Good For New Investors Yes Thanks To Low Fees And Easy Automatic Investing

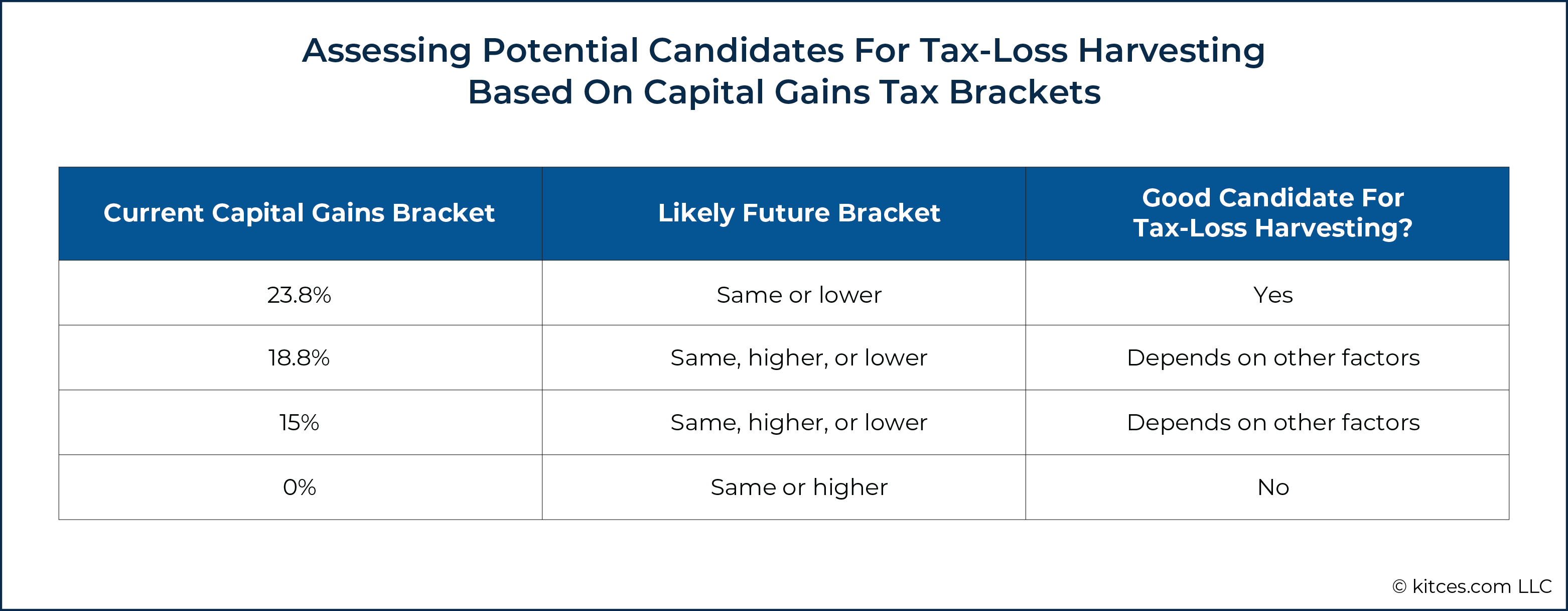

Sophisticated investors have been harvesting losses manually for decades to acquire tax benefits.

. Sales tax is a combination of occupation taxes that are imposed on retailers receipts and use taxes that are imposed on amounts paid by purchasers. When you are involved in an automobile accident one of the first things you may have to do is file a. If Betterment had sold something I had bought manually in my other account or.

Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to. Betterment and Wealthfront made harvesting losses easier and more. Remember wash sales are across all of your different accounts not just per account.

1 Total Loss Claims. And for those with larger amounts of capital Schwabs tax-loss harvesting. Betterment made thousands of transaction lots of which have a zero for the disallowed wash sale loss amount.

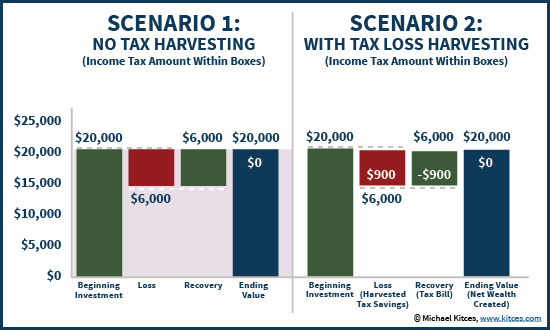

A long-term gain or. In a down market you may consider tax-loss harvesting which can turn portfolio losses into tax breaks. Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end.

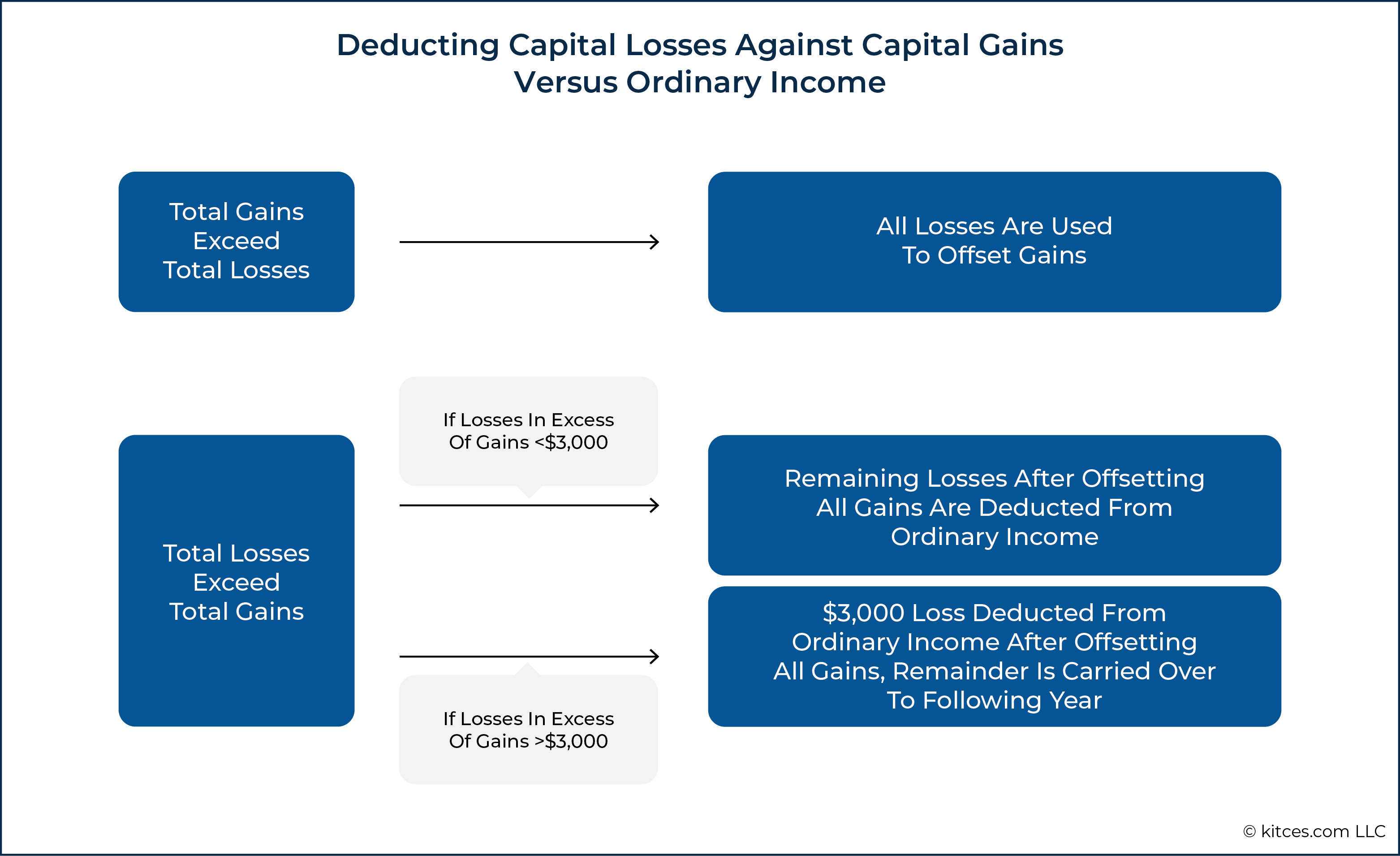

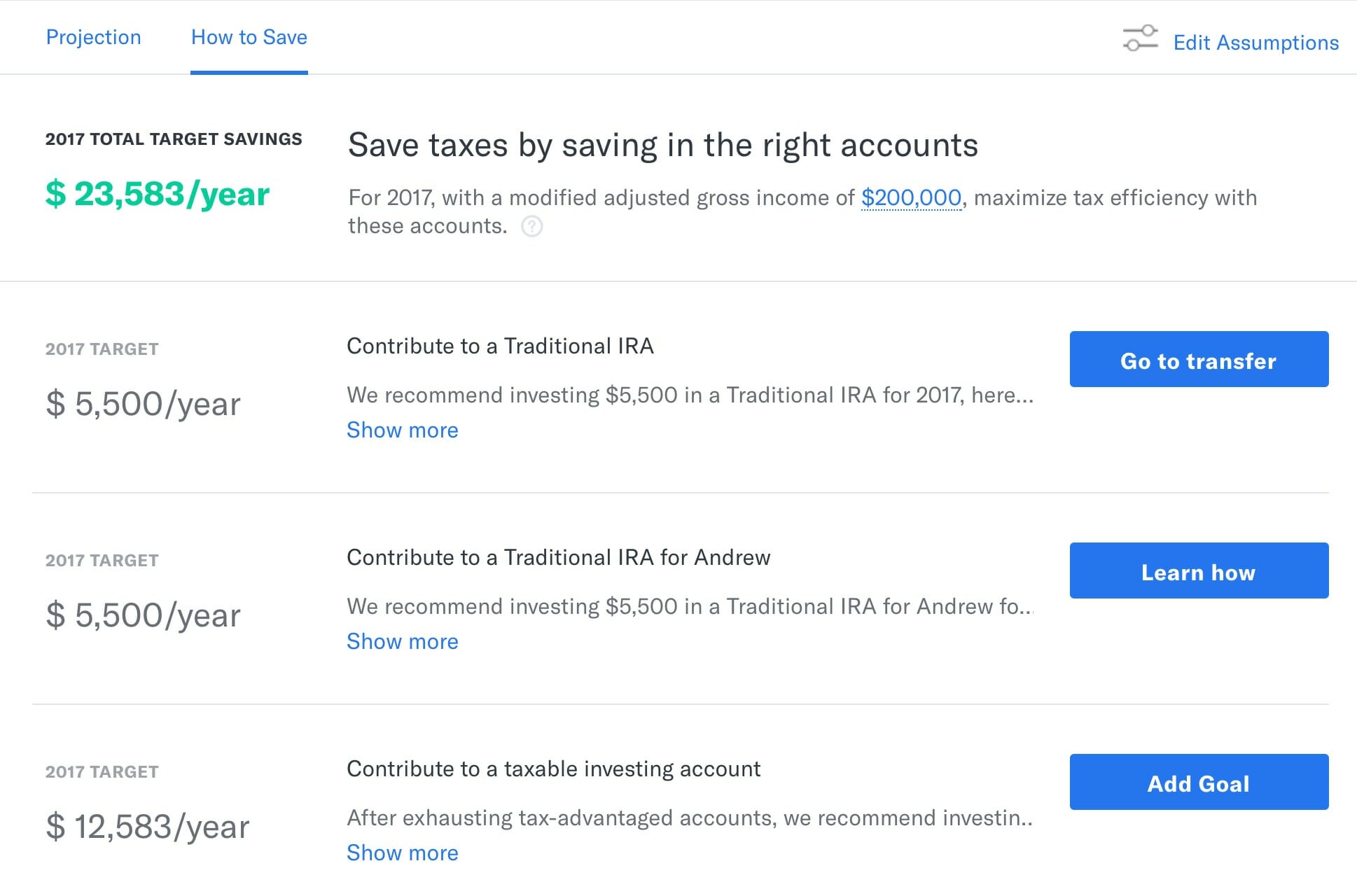

A short-term gain or loss is a sale of a holding you held less than a year. Machinery Equipment Exemption - Manufacturing STATE OF ILLINOIS DEPARTMENT OF REVENUE OFFICE OF ADMINISTRATIVE HEARINGS CHICAGO. The algorithm implements this harvesting daily to maximize up to 3000 annual income deductions from harvested losses with further losses exceeding this amount carried.

Retailers owe the occupation tax to. Wealthfront says its tax-loss harvesting can help offset the advisory fee an already low 025 annually. Tax Loss Harvesting the Wash Sale Rule.

Section 919EXHIBIT A Total Loss Automobile Claims. To do it you simply need to lock in a loss by selling the. But you need to familiarize yourself with the wash sale rule which.

The wash-sale rule is a regulation that prohibits a taxpayer from claiming a loss on the sale of stock while essentially maintaining a position in it.

Wash Sale Rule What To Avoid When Selling Your Investments For A Tax Loss Bankrate

Betterment Review Is This Robo Advisor Right For You

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

What Advisors Need To Know About Tax Loss Harvesting

What Advisors Need To Know About Tax Loss Harvesting

Betterment Tax Loss Harvesting Review What You Should Know About The Betterment Tax Program Advisoryhq

Everything We Learned About Investing Was Wrong That S Why We Need Betterment Frugaling

Owning Vti At Both Vanguard And Betterment Jordan Burnett

The Definitive Guide To Tax Loss Harvesting And Avoiding Wash Minafi

Betterment Review 2022 Is Betterment Legit Betterment Fees Investmentzen

Betterment Review Expert Guide And Analysis

Betterment Review 2022 Is Betterment Legit Betterment Fees Investmentzen

What Is Tax Loss Harvesting Recommanded Strategies And Services

A Detailed Review Of Betterment Returns Features And How It Works

Better Investing With Betterment

Betterment Review 2022 The Original Robo Advisor Service

Better Investing With Betterment

Tax Loss Harvesting Rules How To Tax Loss Harvest White Coat Investor